operating cash flow ratio ideal

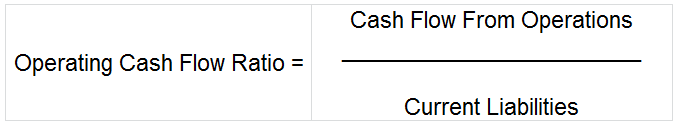

The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share. The operating cash flow ratio is a measure of a companys liquidity.

Operating Cash Flow Ratio Calculator

This ratio is similar to the cash ratio.

. The operating cash flow to sales ratio is a popular metric used to compare current cash flow against sales revenue. Thus in this case the operating. This ratio is a type of coverage ratio and can be.

Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you. If the operating cash flow is less than 1 the company has generated less cash in the period than it. OCR Ratio Cash flow from operating activities Current liabilities 872 975 089.

Hence with the operating cash flow ratio formula. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Each ratio reveals a specific financial aspect of the company.

Instant Bank Pay Ideal for one-off payments. Cash Flow-to-Debt Ratio. In an ideal situation when sales revenue increases cash flow should.

For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time. Operating cash flow Net cash from operations Current liabilities. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

A high cash conversion ratio indicates that the company has excess cash flow. Many financial analysts place more. CCR is a quick way to determine the disparity between a companys cash flow and net profit.

The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Cash flow per share is the after-tax earnings plus depreciation on a per-share basis that functions as a measure of a firms financial strength. The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming.

They use some ratios more frequently used than others depending on the business and its financial needs. Example of Cash Returns on Asset Ratio. Lets consider the example of an automaker with the following financials.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Operating cash flow ratio. However we do not use the most liquid money and assets currently held by the company.

Since the ratio is lower than 1 it indicates that. Operating Cash Flow Margin. The formula to calculate the ratio is as follows.

Operating Cash Flow Ratio. International payments Collect from 30. Operating cash flow margin is a profitability ratio that measures your businesss cash from operating.

Cash returns on assets cash flow from operations Total assets. Instead we use the. Similarly current account savings account CASA ratio of bank grew 270 basis points year-on-year to 42 during the September quarter.

A ratio of 11 is considered ideal.

Cash Flow Statement January February Transactions Accountingcoach

What Is Operating Cash Flow Ratio Guide With Examples

Price To Cash Flow P Cf Formula And Calculator

Cash Flow From Investing Activities Overview Example What S Included

Cash Flow Coverage Ratio Calculator Efinancemanagement

What Is Operating Cash Flow Ratio Accounting Capital

Cash Flow Ratio Analysis Double Entry Bookkeeping

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

How To Calculate Cash Flow The Ultimate Guide For Small Businesses

Operating Cash Flow Ratio Definition Formula Example

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow Vs Profit What S The Difference Hbs Online

Cash Conversion Ratio Financial Edge

How To Calculate Your Debt To Equity Ratio Orba Cloud Cfo

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator